How To File ISF For Blankets

Have you ever wondered how to file an ISF for blankets? Understanding the Importer Security Filing (ISF) process can be a bit overwhelming, especially if you’re new to international shipping. But don’t fret; I’m here to guide you through it step by step. By the end of this guide, you’ll have a solid grasp on how to properly file an ISF specifically for blankets, making your importing experience smoother and more efficient.

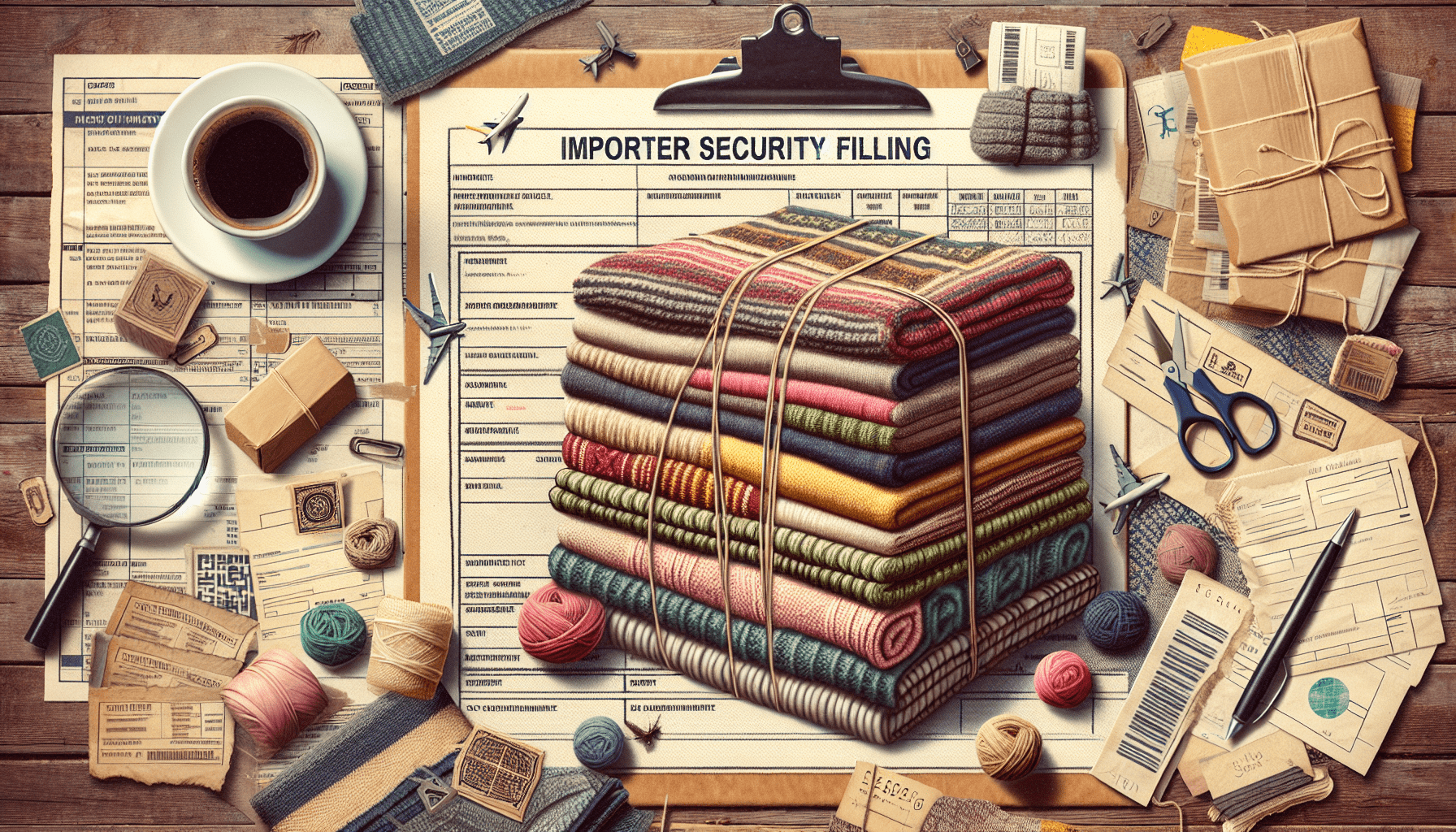

What Is ISF?

Before jumping into the filing process, it’s important to understand what the Importer Security Filing (ISF) is. ISF is a document required by U.S. Customs and Border Protection (CBP) for any cargo arriving by ocean. This filing helps the CBP assess security risks and enforce trade laws. For importers, submitting the ISF accurately and on time is essential to avoid fines or delays.

Why Is ISF Important?

The ISF provides critical information about shipments before they arrive in the U.S. You’re likely asking, why is it crucial? Simply put, it helps ensure security and compliance with U.S. laws. If your ISF isn’t filed correctly, it may result in penalties, increased scrutiny on your shipment, or even denial of entry into the U.S. It’s definitely something you’ll want to prioritize!

Filing ISF for Blankets: An Overview

When importing blankets, you’ll need to provide specific information about the goods you intend to ship. The filing process can seem daunting, but breaking it down into manageable parts can make it more straightforward.

Key Elements of an ISF for Blankets

Your ISF must consist of eight key data elements, which are essential for seamless processing. Understanding these elements will help you prepare your ISF accurately. Here’s what you need to include:

| Data Element | Description |

|---|---|

| 1. Importer of Record | The legal entity responsible for importing the goods. |

| 2. Consignee | The business or person receiving the shipment. |

| 3. Seller | The supplier or vendor of the blankets. |

| 4. Manufacturer | The name of the company that made the blankets. |

| 5. Country of Origin | Where the blankets were produced. |

| 6. Shipping Information | Details about the mode of transport and vessel used. |

| 7. Commodity HTS Code | The Harmonized Tariff Schedule code for blankets. |

| 8. Bill of Lading Number | The unique number assigned to this shipment. |

Understanding Each Data Element

Let’s break down each data element further so you know exactly what information you need to gather before filing your ISF:

Importer of Record

This refers to you, the individual or business responsible for the importation. Ensure that the name and address are current and match the information on your customs bond.

Consignee

The consignee is the individual or business that will take possession of the blankets once they arrive in the U.S. It’s crucial to provide accurate contact details.

Seller

The seller is the entity selling the blankets to you. This could be a manufacturer or a wholesaler. Be sure to include their complete address.

Manufacturer

This involves detailing the company that produced the blankets. Often, the seller and manufacturer may be the same, but it’s important to clarify both roles in your ISF.

Country of Origin

Each blanket should specify where it was manufactured, which plays a key role in determining tariffs and compliance with trade agreements.

Shipping Information

The shipping details will include the method of transport — whether it’s by container, truck, or air — along with the vessel or flight number.

Commodity HTS Code

The Harmonized Tariff Schedule (HTS) code is essential for classifying the blankets you’re importing. This code affects the tariffs you may be required to pay.

Bill of Lading Number

Lastly, the bill of lading number is a unique identifier that links your ISF to the specific shipment. It’s often provided by your freight forwarder or shipping company.

Preparing to File ISF

Now that you understand the components of ISF, it’s time to prepare for the actual filing process. You want to be sure you have all the necessary information gathered and ready before proceeding.

Gathering Necessary Documentation

Before filing your ISF, collect all relevant documentation related to your import. This includes:

- Purchase orders

- Invoices

- Shipping terms

- Customs bond (if applicable)

- Contact information for your customs broker

Having these documents handy will streamline the filing process and help avoid potential errors.

Identifying Your Customs Broker

While you can file an ISF on your own, collaborating with a customs broker can save you a lot of hassle. They’re experienced professionals who understand the intricacies of ISF filing and can help ensure your submission is accurate. If you’re new to importing, this might be the best route for you.

The ISF Filing Process

You’re now ready to file your ISF. Let’s go through the steps involved in this critical process.

Choosing the Filing Method

Considering how you’d like to submit your ISF is an important first step. There are generally two methods available:

-

Online Submission: Many importers file their ISF through the Automated Commercial Environment (ACE) portal, managed by CBP.

-

Customs Broker: If you’re working with a customs broker, they can file the ISF on your behalf, which may be a more convenient option.

Submitting Your ISF

Once you’ve chosen your filing method, you can submit your ISF. Here’s how to do it for both methods:

Online Submission

To file electronically, follow these steps:

- Register for an ACE account. This will allow you to access the necessary tools for filing.

- Make sure you’re compliant with your bond requirements.

- Fill out the ISF data elements, as discussed earlier.

- Review all details carefully to ensure accuracy.

- Submit your ISF at least 24 hours before your cargo is loaded onto a vessel destined for the U.S.

Filing Through a Customs Broker

If you’re opting for a customs broker, provide them with all the necessary data elements and copies of relevant documentation. Keep open communication to confirm they’ve submitted your ISF correctly.

Monitoring Your ISF Status

Once you’ve filed your ISF, it’s wise to keep an eye on its status. Here are some tips on how to ensure everything is moving smoothly:

Checking with Your Customs Broker

If you used a customs broker, they can provide updates on the filing status and alert you to any potential issues.

Utilizing the ACE Portal

If you filed online, the ACE portal allows you to review the status of your ISF. Checking back often can give you peace of mind that all is well.

After Filing ISF

Congratulations! You’ve successfully filed your ISF. However, your job is not quite over.

Compliance and Post-Filing Processes

While you wait for your blankets to arrive, make sure you stay compliant with any other necessary U.S. Customs regulations. This means preparing for the next steps in the customs clearance process, including the payment of duties and taxes.

Understanding Potential Issues

Be aware that issues might arise after filing your ISF. Here are some common challenges:

-

Information Discrepancies: If any data elements don’t match up with the documentation you provided, it may trigger an inspection or delays.

-

Late Filings: Remember, your ISF must be submitted at least 24 hours before your cargo loading. Late submissions can result in penalties.

Common Mistakes to Avoid

Even seasoned importers can make mistakes when filing an ISF. Here are a few common pitfalls to avoid:

Incomplete Information

Always double-check to make sure you’ve included all required data elements. An incomplete ISF can lead to delays or fines.

Misclassifying Goods

Ensure you select the correct HTS code for your blankets. Misclassification can create significant issues with customs that may impact duties owed.

Not Staying Informed

Customs regulations can change, so stay updated on the latest requirements. Following industry news or joining a relevant trade group can be beneficial.

The Importance of Accurate ISF Filing

Filing your ISF accurately protects your interests as an importer and ensures a smooth delivery process. Remember, compliance is key; the more diligent you are about your filing, the easier your importing journey will be.

Benefits of Proper ISF Submission

Here are some benefits of filing your ISF correctly:

-

Reduced Inspection Rates: An accurate ISF lowers the likelihood of your shipment being flagged for a customs inspection.

-

Faster Clearance: When CBP has the accurate information they need, your shipment can be cleared more quickly.

-

Better Trade Relations: Consistently complying with customs regulations enhances your reputation and could lead to better business relations in the long run.

Conclusion

Now that you understand how to file an ISF for blankets, you’re better prepared to tackle the importing process with confidence. Keeping track of the relevant data elements, filing accurately, and navigating post-filing responsibilities will set you up for success.

As you dive into your importing journey, remember that you have resources available, whether it’s your customs broker or regulatory web pages. If you stay informed and organized, you’ll make your imports less stressful and much more efficient. Happy importing!